In the information age, we are inundated with data to such a degree we can get distracted from our principal wealth-creation goals. Neuroscientist Dr. Daniel J. Levitin points out in his book, The Organized Mind, concerning a never-ending stream of social media, news, and career info, that “our brains are hungrily soaking all this in because that is what they’re designed to do, but at the same time, all this stuff is competing for neuro-attentional resources with the things we need to know to live our lives.” And one of the key things we need to know is how to get our finances on track for retirement!

Why people fail to invest An article in CNN noted after surveying 1,000 people about retirement stated that “many people spend more time researching which car to buy or where to go on vacation than they do investigate the right investments. More than half said they had spent five hours or more researching the last time they bought a car, and 39% said they spent more than five hours exploring vacation possibilities. Meanwhile, a mere 11% said they had spent that amount of time evaluating investment options.

Dr Levitin makes a case for the need for categorical thinking to wade through the information best suited for our lifestyle. Applying his wisdom, the secret is categorizing how you break down your financial needs for the future and then determining how you prioritize your next steps concerning your goals. By asking how you organize your finances, it forces you to look at and list the most pertinent categories with a realistic application for financial survival:

To be successful at retirement planning, you may need to engage the help of a professional advisor, someone who often does not charge for his or her services (some advisors are paid via other means), as well as fund specialists and/or investment managers trained to help you achieve financial success. Again, when applied to finance, the logic of The Organized Mind is to get financial guidance using the available fiscal counsel resources. Again, Levitin summarizes this concept of getting someone to handle the daily distractions of life — and unfortunately, many view the financial organization as a distraction lumped in with all the other media distractions when it comes down to getting through a basic day, month, year, and so on! It is little wonder most people procrastinate when it comes to their finances.

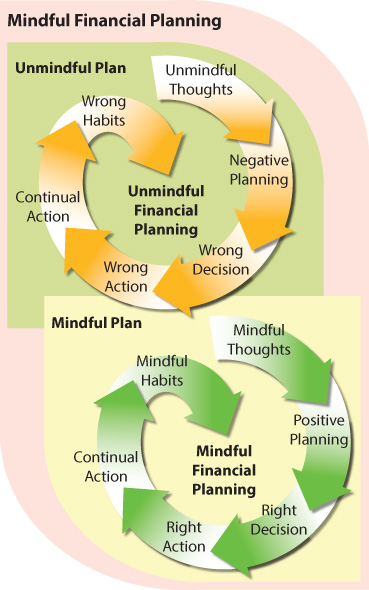

Mindful financial strategies must be organized.

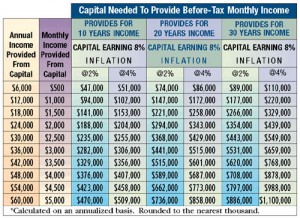

We all want success in our careers, workplaces, and investment planning. Why not talk to us about implementing an investment strategy? We have the trained expertise to help you get on the right track. Look at the graph below depicting the capital needed to retire. And ask yourself, “Is it time for me to get help?”

Graph Source: Adviceon®Media